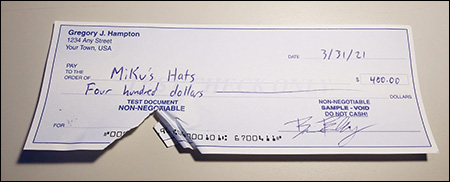

If critical information like the account or routing. But, before you try cashing a check, whether torn or not, it’s vital first to ensure that it is valid.

Cashing a damaged check may or may not be possible depending on several reasons.

Can you cash a damaged check. Whether you can cash or deposit a torn check depends on the institution cashing the check and the check�s exact condition. $3 for checks that are worth up to $1,000 and $6 for checks that are worth $1,000 to $5,000. Of course, you have other options.

Legally, a bank can refuse to cash any check that is older than six months. In that case you need a new check, but if everything i mentioned is there, a ripped check can be cashed, even one. When it comes to a check that is torn or damaged, there are a few different ways to cash them.

In this case, the place where you’re cashing your check may be willing to give you looser terms. In some cases, you may be able to still cash a badly damaged money order with the original issuer such as the money transfer agent or other financial institution, as they will normally be able to determine whether the money order is, in fact, legitimate or not. So if you’re cashing a $2,000 cashier’s check at a store that charges a 5% fee, you’ll pay $100 just to get your money.

Although risky, cash checking stores are also an. The reason for that is because, with an automated machine, it can’t work for you and tries to help you out. Avoid signing the check, and, if possible, don’t tear the check away from the check stub.

But, before you try cashing a check, whether torn or not, it’s vital first to ensure that it is valid. If you have an unfortunately aligned tear, the rollers will “pinch” it and roll it up, ruining the document completely. Is it possible to cash a ripped check?

If you wait too long to cash a check, a bank can refuse to cash it. If critical information like the account or routing. Retain the envelope, so you have a clear record of when the check was received.

If you have a torn, damaged, or ripped check its often smarter to just cash it with the teller. If, however, you�re resourceful enough, there�s a workaround that you can try to receive the money in your hand. The main thing you’re trying to avoid with damaged checks is this:

Cashing a damaged check may or may not be possible depending on several reasons. You can tear it or can dispose it safely. There are limits on how much you can cash at walmart.

Here are a couple of retail stores where you can cash cashier’s checks: The short answer is, it depends on your bank’s policies and how damaged the check is. You can visit your bank to ask if they�re able to process a damaged check and, if necessary, ask whoever wrote the check to issue a new one.

Whether you can “cash out” an insurance claim check depends on a number of factors, including the type of damage and your auto insurance provider. This can be convenient as you can cash your check when you’re doing your regular shopping. When it comes to a check that is torn or damaged, there are a few different ways to cash them.

If you live in or near washington, d.c., you can deliver the damaged currency in person to the bureau of engraving and printing. A number of businesses operate solely for this purpose. You can cash your check at grocery stores, major retailers and supermarket chains.

If the check itself has a bank’s logo on it, that should be your first stop. Cashier’s checks can be cashed at all of the same places mentioned above. For most of the year, you can cash a check as long as it’s under $5,000.

Where to cash a cashier’s check. For you to get your money quickly and inexpensively, you need to. This route typically has the most success.

Ripped checks can be cashed if you have all of it and can scotch tape it together. If anything important is missing like the drawers signature, date, bank, amount, who it was written to, you are out of luck because those are the basic elements of a negotiable check. When a check goes through the track, the scanner’s rollers and/or drive belt grip it from the bottom.

Before cashing any insurance check, consult with an injury attorney in los angeles. You’ll need to bring the check and a valid id with you to the store. If you�re cashing a payroll or government check,.

This clearly means, there is no way to cash the check either form banks or from any of the check cashing places. To cash a claim check made out to both of you, normally you�d endorse the check and send it onto the lien holder, who will may require you send documentation that the repairs were made to the. You should never dispose the void checks in a carelessly, as it carries the bank account number and the routing number.

In other words, void checks means it is a sort of cancelled checks. Mail mishaps or an accident that occurs after a check reaches you can result in a torn check. The bureau accepts personal deliveries of damaged or mutilated currency between the hours of 8:00 am and 11:30 am, and between 12:30 pm and 2:00 pm.

One of the easiest ways is to go through a teller.